As a small business owner in the tech industry, managing your finances is crucial to the success of your company. Effective budgeting can help you make informed decisions, maximize profits, and grow your business. Here are some smart budgeting tips to help you navigate the financial landscape of your small tech business.

1. Set Clear Financial Goals

Before you can create a budget, you need to establish clear financial goals for your small tech business. Whether you want to increase revenue, expand your product line, or improve customer service, having specific goals in mind will help guide your budgeting decisions. Make sure your goals are realistic, measurable, and align with the overall vision of your company.

2. Track Your Expenses

One of the most important aspects of budgeting for small tech businesses is tracking your expenses. Keep detailed records of all your business expenses, including software licenses, equipment purchases, marketing costs, and employee salaries. This will help you identify areas where you can cut costs and make informed decisions about future investments.

3. Create a Budget Plan

Once you have a clear understanding of your financial goals and expenses, it’s time to create a budget plan for your small tech business. Start by listing all your expenses and income sources, then allocate funds to different categories based on priority. Make sure to set aside a portion of your budget for unexpected expenses or emergencies.

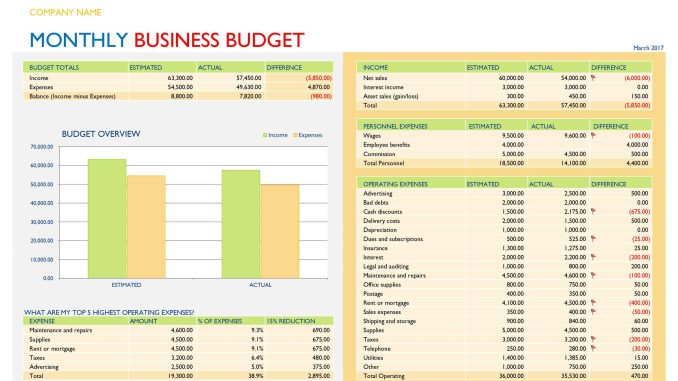

4. Use Budgeting Tools

There are many budgeting tools and software available that can help small tech businesses manage their finances more effectively. Consider using tools like QuickBooks, FreshBooks, or Mint to track your expenses, create budgets, and generate financial reports. These tools can save you time and provide valuable insights into your company’s financial health.

5. Monitor Your Budget Regularly

Creating a budget is just the first step. To ensure its effectiveness, you need to monitor your budget regularly and make adjustments as needed. Keep track of your actual expenses and compare them to your budgeted amounts. If you notice any discrepancies or unexpected expenses, take action to course-correct and stay on track with your financial goals.

6. Negotiate with Vendors

As a small tech business, you have the opportunity to negotiate with vendors to get the best deals on software licenses, equipment purchases, and other business expenses. Don’t be afraid to ask for discounts or explore alternative vendors to lower your costs and maximize your budget. Building strong relationships with vendors can also lead to long-term cost savings for your business.

7. Invest in Technology Wisely

When budgeting for your small tech business, it’s important to invest in technology wisely. Consider the long-term benefits of upgrading your software, hardware, or infrastructure before making any purchasing decisions. Look for cost-effective solutions that can help improve efficiency, productivity, and overall performance without breaking the bank.

8. Leverage Data Analytics

Data analytics can be a powerful tool for small tech businesses looking to optimize their budgeting strategies. Use data analytics tools to track key performance indicators, identify cost-saving opportunities, and make data-driven decisions about your budget. By leveraging data analytics, you can gain valuable insights that can help you make more informed financial decisions for your business.

Conclusion

Effective budgeting is essential for the success of small tech businesses. By setting clear financial goals, tracking expenses, creating a budget plan, using budgeting tools, monitoring your budget regularly, negotiating with vendors, investing in technology wisely, and leveraging data analytics, you can optimize your budgeting strategies and set your business up for long-term success in the tech industry.